Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

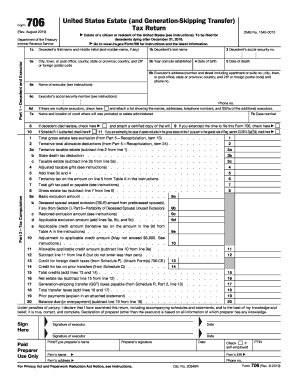

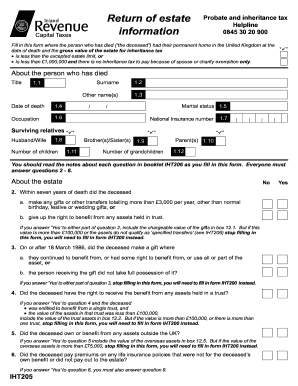

The iht205 form is an Inheritance Tax form used in England and Wales. It is used to report the value of an estate when someone dies. The form is used by the executor or administrator of the deceased’s estate when applying for a Grant of Representation. This form is part of the process of applying for the grant, which allows the executor or administrator to deal with the deceased's assets.

What is the purpose of iht205 form?

The iht205 form is a declaration form used by the UK HM Revenue and Customs (HMRC) for Inheritance Tax (IHT). The form is used to declare the value of a deceased person's estate and the amount of IHT that needs to be paid. It is used to formally declare the estate for IHT purposes and must be completed and submitted to HMRC before any IHT can be paid.

What information must be reported on iht205 form?

The information required to be reported on an IHT205 form includes: the name and address of the deceased, the date of death, the executor's name and address, the gross value of the estate, the total amount of Inheritance Tax due, and the bank details of the executor so that the tax can be paid.

When is the deadline to file iht205 form in 2023?

The deadline to file the IHT205 form in 2023 is April 5th, 2023.

Who is required to file iht205 form?

In the United Kingdom, the IHT205 form is used for reporting the estate of someone who has died, provided certain criteria are met. It is meant for estates that are below the Inheritance Tax threshold and do not have a claim for transfer of the unused Inheritance Tax threshold.

The following people are required to file an IHT205 form:

1. Executors or personal representatives of the deceased, if the estate meets the criteria mentioned above.

2. The person responsible for administering the estate is required to file the form within 12 months of the death.

It is important to note that if inheritance tax is due on the estate, or if the estate doesn't meet the criteria for using the IHT205 form, then a different form, known as the IHT400, may need to be filed instead. It is recommended to seek professional advice or consult the UK government's official guidance to determine the specific requirements for filing the IHT205 form.

How to fill out iht205 form?

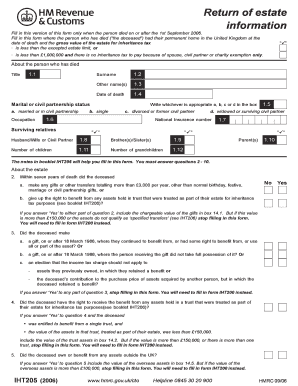

To fill out the IHT205 form (also known as Inheritance Tax form), follow these steps:

1. Obtain the IHT205 form from the UK government's website or your local tax office. You can download or request a physical copy of the form.

2. Begin by providing the basic details about the deceased person. Fill in their full name, address, and date of death.

3. Next, enter the details of the person who is responsible for handling the deceased person's estate. This may include their name, address, and relationship to the deceased.

4. Proceed to Section A, where you must declare whether the deceased person had a Will at the time of death. Tick the appropriate box to indicate the presence or absence of a Will.

5. Section B requires you to provide information about the deceased person's estate. This includes details such as property, stocks, bank accounts, valuables, and other assets they owned. List each item or asset separately, along with its estimated value.

6. In Section C, you need to confirm whether the deceased person made any gifts within seven years before their death. If such gifts were made, provide the necessary information about the gifts and their value.

7. Section D is for recording any debts or liabilities that the deceased person left behind. This may include mortgages, loans, or other debts. List each debt separately, along with its value.

8. Continue to Section E, where you declare if the deceased person had any prior interests in trust funds or settlements. If relevant, provide the necessary details.

9. In Section F, you must declare any exemptions or reliefs that may apply to the deceased person's estate. These can include things like spouse or civil partner exemption, charity exemptions, or agricultural relief. Tick the boxes that are applicable to the estate.

10. Finally, sign and date the form, including your name and capacity (e.g., executor, administrator, or legal representative).

11. Review the completed form thoroughly to ensure accuracy and completeness. Submit the form to the appropriate tax office or send it electronically, if applicable.

Keep in mind that IHT205 is for estates that have no Inheritance Tax to pay or is subject to reliefs or exemptions. If the estate exceeds the threshold or is more complex, the IHT400 form may be required. Consider seeking professional advice or assistance if you are unsure about any aspect of completing the form.

What is the penalty for the late filing of iht205 form?

The Inheritance Tax Return form (IHT205) is used to report the value of the estate and any Inheritance Tax due. The penalty for late filing of the IHT205 form can vary depending on the circumstances.

If you file the form more than 3 months late, there is an initial penalty of £100. If you file more than 6 months late, there is an additional penalty of £10 per day for up to 90 days (up to a maximum of £900). If you file more than 12 months late, there can be additional penalties based on a percentage of the Inheritance Tax due.

It's important to ensure that the IHT205 form is filed correctly and on time to avoid any penalties.

How can I manage my iht205 form directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your iht205 form 2023 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

Where do I find iht205 form download?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the iht205 form pdf in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit iht 205 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your iht205 online form, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.